how to work out vat

Thanks Guys Rebeccas yours was the formula I needed as I knew the vat amount but needed to convert it back to net. In other words you can.

|

| Working Out Your Vat Return Vat Guide Xero Uk |

For example a rate of 20 gives you a ratio of 120 thats 20100 02 1 12 That makes it sound.

. Work out the VAT on a price or figure. Make a note of the VAT collected on sales. Add both types of VAT. At the very beginning add a column for VAT Amount.

If you have a figure you want to add VAT against multiply by 020 to find the VAT value or 120 to find the gross value including VAT. Calculate the VAT amount. Value Added Tax VAT is charged on most goods and services purchased in the UK. In Cell E2 write this formula and hit enter.

Please be aware that the VAT rates used in the example are. The following formulas can be used to calculate your VAT your net and gross prices. Adding removing and calculating VAT for your invoices can be done with a couple of clicks by using our VAT calculator. We prepared below the table in Excel Spreadsheet.

I had a complete brain freeze I know you 47 x 7. You will have your VAT. Take your VAT rate divide it by 100 and then add 1. Employees using personal vehicles for work.

VAT inclusive and wanted to reverse calculate VAT to find out how much they owed to HMRC theyd use the VAT subtraction example below. Basically it is a tax on business transactions. The VAT Calculator can be used to-Calculate VAT. Make a note of the VAT paid on your business purchases.

Calculating VAT for VAT-inclusive and VAT-exclusive prices has never been easier. Simply enter the gross sum choose vat calculation operation include or exclude tax percentage and press Calculate or enter button to calculate VAT amount. Luckily its very easy to work out. Check the VAT rate.

The VAT Calculator helps you calculate the VAT to add or subtract from a price at different rates of VAT. Calculate the VAT inclusive portion of a price for a product or service. Next select cell E5 and insert the following formula. You can work out VAT.

Check the VAT rate. If an amount already has VAT included you can find the VAT excluded amount by dividing the original amount by 1 VAT percentage which is 15 in South Africa. Only 3 easy steps for VAT calculation. But recall that 15 means 15 per.

Calculating VAT for VAT-inclusive and VAT-exclusive prices has never been easier. Run the VAT formula. How to use the VAT calculator. If you know the price without VAT added on.

For a purchase price of x we multiply x by 15. How to work out VAT in four steps. For example an invoice of 125 multiplied. Remove VAT from a figure.

VAT - or Value Added Tax - is charged by businesses at the point of sale of goods and services sold in the UK and the Isle of Man. How to work out VAT. The maths for working out VAT is quite straightforward as. Only 3 easy steps for VAT calculation.

How to Calculate VAT Backwards. Formula for calculating VAT. Working out VAT when only the gross price and VAT rate are available takes several steps. So to calculate the VAT on any purchase price we need to multiply the price by the VAT percentage.

To remove VAT from a VAT-inclusive figure youll need work the figure out in reverse. First of all you need to divide the total price including VAT by 100VAT rate for example 110 for. How to use the VAT calculator. Lets say I have paid 100 for a product including VAT.

When approaching the topic of paying VAT to the HMRC the primary consideration lies in your recording and accounting activities. If however you are VAT-registered and trading above the VAT threshold then the full cost method must be used for VAT.

|

| Calculating Vat Youtube |

|

| Excel Vat Formula |

|

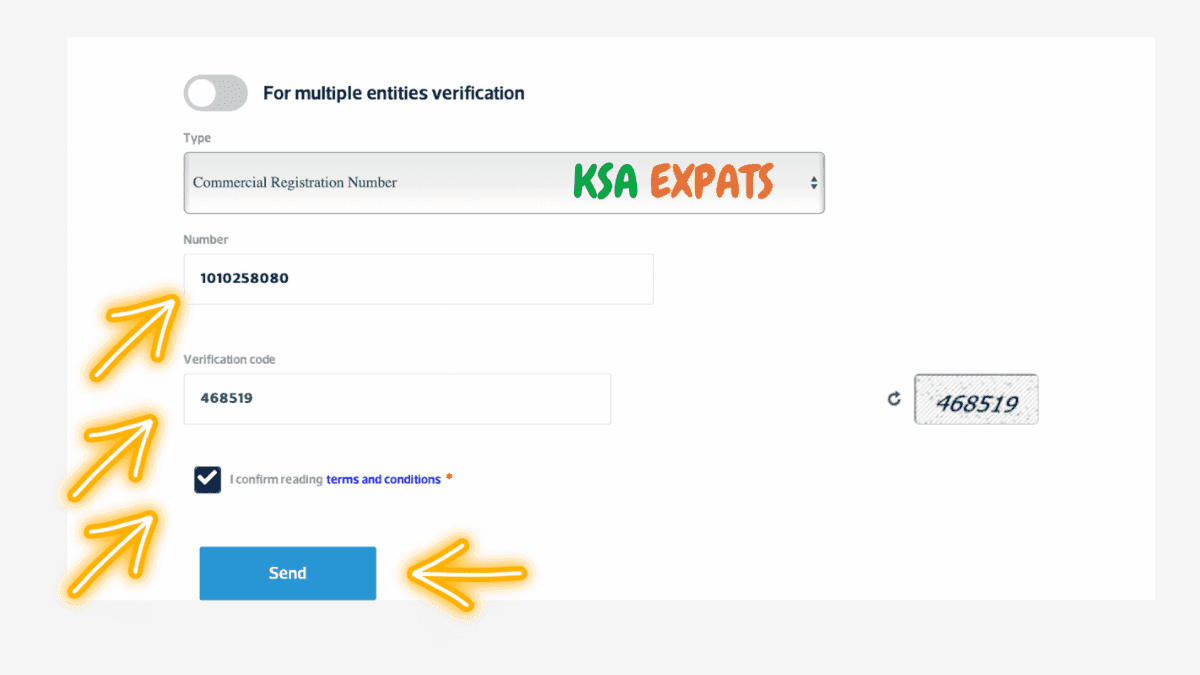

| How To Find Vat Number In Saudi Arabia Using Cr Number Ksa Expats |

|

| Solved How To Add Vat Number |

|

| Example 9 Value Added Tax Vat Waheeda Bought An Air Cooler For |

Posting Komentar untuk "how to work out vat"